UK Health Insurance Cost: What Determines Your Premium?

When looking at UK health insurance cost, the amount you pay each month for private medical coverage in the United Kingdom. Also known as private health insurance premiums, it reflects a blend of personal factors and market conditions. Understanding this cost helps you decide whether private cover makes sense alongside the NHS.

Key Players Shaping the Price Landscape

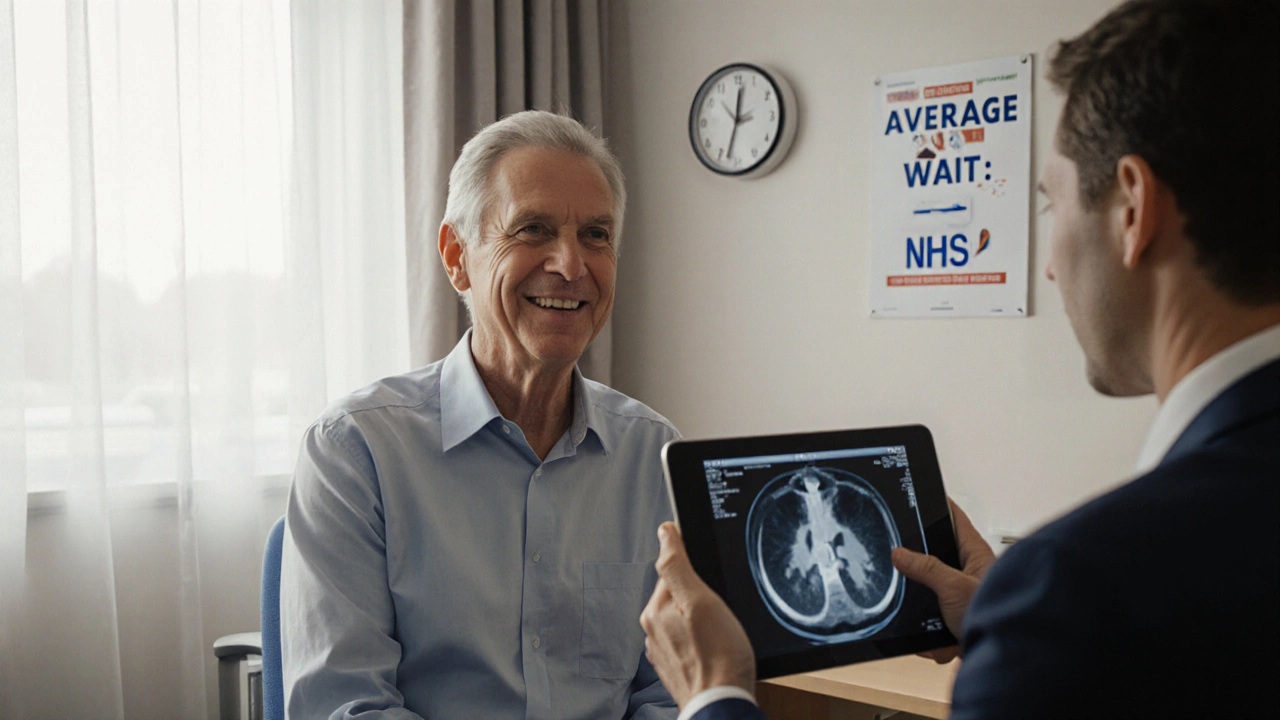

One major private health insurance, a voluntary scheme that offers faster access to specialists and elective procedures directly influences the overall cost picture. At the same time, the NHS, the publicly funded health service that provides free care at the point of use sets a baseline for what services are already covered, affecting how much extra you might need. The relationship is simple: the more comprehensive the NHS provision, the lower the perceived need for expensive private add‑ons, and vice versa.

Age, location, and health status form the core attributes that insurers use to calculate premiums. For example, a 30‑year‑old living in the Midlands might pay less than a 55‑year‑old in London because life expectancy and regional healthcare demand differ. Coverage level—whether you choose a basic package covering only inpatient care or an all‑inclusive plan with dental, optical, and physiotherapy—adds another layer of cost variation.

Policy type also matters. Some plans are “remedial” or “therapeutic,” focusing on chronic condition management, while others are “wellness‑oriented,” emphasizing preventive care and routine check‑ups. These distinctions create semantic triples such as: "UK health insurance cost encompasses policy type", "policy type requires specific coverage options", and "coverage options influence monthly premiums". Each of these connections helps you see why two seemingly similar quotes can differ dramatically.

Beyond personal factors, market forces play a role. Competition among providers, regulatory changes, and inflation in medical costs all shift the baseline price. When a major insurer raises its rates, the average cost across the sector tends to rise, prompting consumers to shop around for better value. Likewise, new technologies or treatments entering the market can push premiums up if they’re added to standard coverage.

So, what can you do to keep the UK health insurance cost in check? Start by comparing plans that match your health needs and budget. Look for policies that offer lower excess amounts or tiered benefits that let you pay only for what you truly use. Consider a multi‑year contract if it locks in a lower rate, and don’t forget to ask about discounts for healthy lifestyle habits or group memberships.

In the sections that follow, you’ll find articles breaking down everything from how age affects premiums to the exact differences between NHS waiting times and private‑sector access. Whether you’re weighing a switch to private cover or just curious about your current plan, the insights ahead will give you a clearer picture of what drives your insurance bill and how you can manage it effectively.

Is it worth having private health insurance in the UK?

Private health insurance in the UK offers faster access to treatment but comes at a cost. Learn when it’s worth it, how much it costs, and what alternatives exist - without the hype.

Categories: Healthcare Insurance UK

0

What Is the Monthly Cost of Health Insurance in the UK? 2025 Guide

Explore the 2025 average monthly cost of private health insurance in the UK, see how age, plan type and provider affect premiums, and learn tips to lower your bill.

Categories: Healthcare Insurance UK

0