SingleCare Card Value Calculator

Potential Savings Summary

Drug:

Cash Price: $

SingleCare Price: $

Estimated Savings: $ (%)

Important Notes

These are estimates based on average SingleCare discounts. Actual savings may vary by pharmacy and location.

Note: This tool does not replace insurance and should be used for informational purposes only.

Finding a glossy SingleCare card tucked inside an envelope can feel like a surprise that needs a quick decode. Is it a scam, a gift, or just another piece of junk mail? Below we break down exactly what the card is, why it landed on your doorstep, and how (or whether) you can turn it into real savings on prescriptions.

Key Takeaways

- SingleCare is a free prescription‑discount program that works with most U.S. pharmacies.

- Mail‑order cards are sent because the company bought or rented mailing lists and targets people who likely pay out‑of‑pocket for meds.

- The card is safe to use, but it does not replace insurance and it won’t work on every drug.

- Activating the card only takes a few minutes on the SingleCare website or app.

- Alternative discount cards (GoodRx, RxSaver, Blink Health) may offer better rates for specific prescriptions.

What Is the SingleCare Card?

SingleCare is a free prescription‑discount program that partners with pharmacy chains, independent pharmacies, and pharmacy benefit managers to negotiate lower prices for thousands of drugs. The service is not insurance; it offers a discount that you apply at checkout, similar to a coupon.

The program claims to have saved users more than $1billion since its launch in 2015, and it reports an average 30‑40% reduction on common prescriptions such as antihypertensives, cholesterol pills, and allergy meds.

Why Did They Send Me a Card?

SingleCare runs a direct‑mail marketing engine that buys or rents mailing lists from data brokers. Those lists typically include people who have:

- Indicated they pay for prescriptions out of pocket (e.g., no prescription drug coverage).

- Recently searched for medication prices online or filled a prescription at a pharmacy.

- Demographics that match the company’s target age and income brackets.

When your name appears on one of those lists, SingleCare prints a physical card, slaps a postage stamp on it, and ships it out. The envelope often mentions a “special offer” or “exclusive savings” to boost open rates.

Because the card is free and does not require a credit check, it’s a low‑cost way for SingleCare to grow its member base.

Is the Card Legitimate and Safe?

Yes-SingleCare is a legitimate business registered in the United States, and its discount model has been vetted by the Better Business Bureau (BBB) with an A+ rating.

That said, there are a few safety considerations:

- The program collects basic personal information (name, address, email) to verify eligibility and send updates. It does not request credit card numbers unless you choose to purchase a medication through its online pharmacy.

- Because the discount is applied at the point of sale, the pharmacy will still see your personal health information in the prescription record, which is covered by HIPAA in the U.S.

- The card does not interfere with any existing health insurance; it simply adds a discount on top of whatever you already pay.

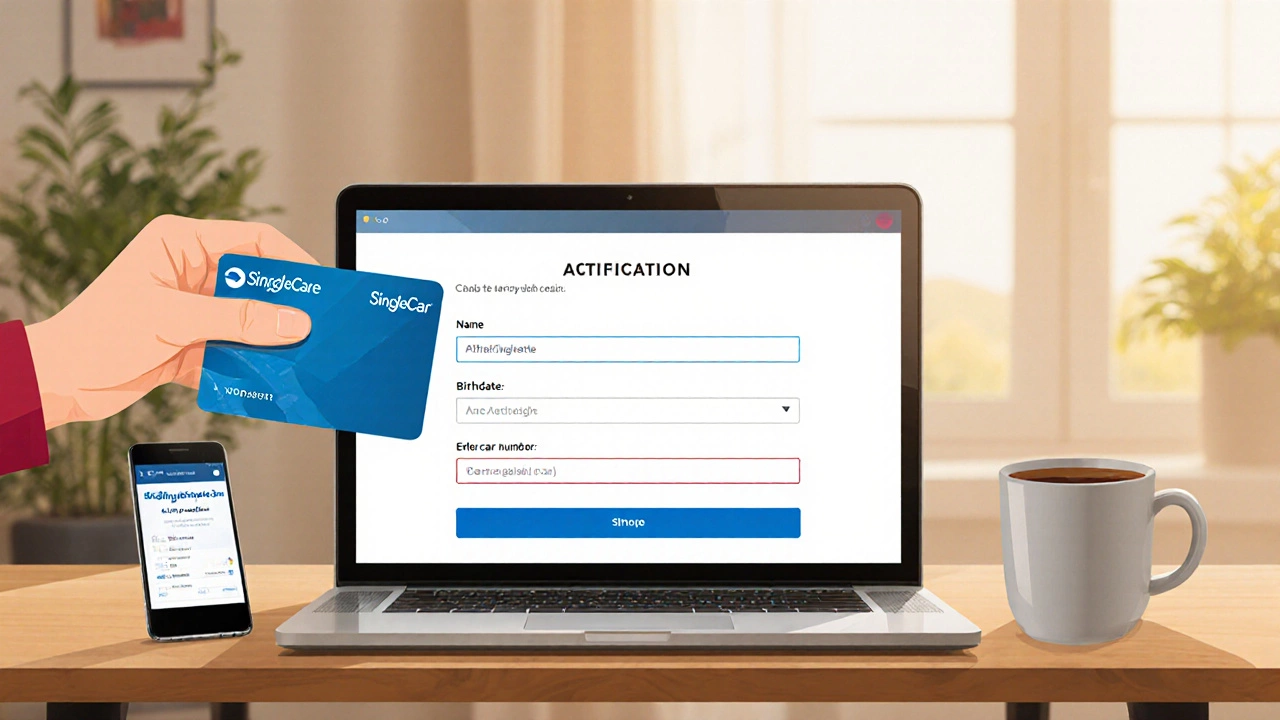

How to Activate and Use the SingleCare Card

Getting the card from a piece of mail to a working discount is a short process:

- Visit singlecare.com or download the SingleCare app.

- Enter the 12‑digit card number printed on the front of the mailed card.

- Fill in basic details (full name, birth date, zip code) to create a free account.

- Search for your prescription by drug name, dosage, and quantity.

- Compare the SingleCare price with the price your pharmacy lists. If you like the discount, click “Use Coupon” and note the code.

- Present the printed coupon or the digital code at the pharmacy checkout. The pharmacist will apply the discount before you pay.

Most major chains-CVS, Walgreens, Walmart, Kroger, and many independents-accept the SingleCare coupon. Some smaller pharmacies may ask you to print the coupon ahead of time.

Potential Savings: Real‑World Numbers

Below are typical discount ranges observed for popular drug categories. All figures are averages from user reports in 2024 and may vary by location.

| Drug Category | Cash Price (USD) | SingleCare Price (USD) | Typical Savings |

|---|---|---|---|

| Antihypertensive (e.g., Lisinopril 10mg) | $30‑$40 | $18‑$22 | 40‑45% |

| Statin (e.g., Atorvastatin 20mg) | $25‑$35 | $14‑$19 | 45‑50% |

| Allergy (e.g., Cetirizine 10mg) | $12‑$18 | $7‑$9 | 38‑45% |

| Diabetes (e.g., Metformin 500mg) | $20‑$30 | $12‑$16 | 35‑45% |

| Brand‑Name (e.g., Advair Diskus) | $260‑$300 | $150‑$180 | 40‑45% |

These numbers illustrate why many people keep the card even after a single use; the potential savings add up quickly across multiple prescriptions.

Alternative Discount Programs - Quick Comparison

If you already have a SingleCare card, you might wonder how it stacks up against other free discount tools. The table below focuses on four of the most popular options in the U.S.

| Program | Coverage (Number of Drugs) | Typical Discount Range | App/Website Availability | Best For |

|---|---|---|---|---|

| SingleCare | ≈70% of US market drugs | 30‑45% | iOS, Android, Web | Broad coverage, easy coupon printout |

| GoodRx | ≈80% of US market drugs | 40‑55% | iOS, Android, Web | Highest discounts on brand‑name meds |

| RxSaver | ≈65% of US market drugs | 25‑40% | Web only (printable coupons) | Simple web‑only interface |

| Blink Health | ≈55% of US market drugs | 35‑50% | iOS, Android, Web | Direct purchase at discounted price |

In practice, many users run a quick search on both SingleCare and GoodRx before checkout to snag the deeper discount. The effort is minimal-just a second of typing.

Common Concerns and How to Address Them

- Will using the card affect my insurance? No. The discount applies after insurance processing, or if you pay cash. It never reduces the amount your insurer pays.

- What if the pharmacy says the coupon won’t work? Verify that the pharmacy is part of SingleCare’s network (the website lists participating chains). If the drug is excluded, try an alternative discount program or ask the pharmacist about a therapeutic equivalent.

- Is my personal data being sold? SingleCare’s privacy policy states they use data to improve services and may share de‑identified analytics with partners, but they do not sell personal identifiers.

- Can I use the card for veterinary prescriptions? No. The program only covers human medications.

What Happens If I Don’t Want the Card?

If the envelope feels like junk mail, you can simply recycle it. There’s no activation required, so the card won’t generate fees or charges just by sitting in a drawer. If you’re curious but hesitant, create an account with just your email-no credit card needed-and explore the price list before committing.

Frequently Asked Questions

Is the SingleCare card a replacement for health insurance?

No. SingleCare provides a discount that you apply when you pay for a prescription. It does not cover medical services, copays, or premiums like traditional health insurance.

Do I need to enter my credit card information to use the card?

Only if you choose to purchase medication through SingleCare’s online pharmacy. For in‑store coupons, no payment information is required during activation.

Can I use the SingleCare discount on specialty drugs?

Specialty drugs are sometimes excluded because they involve complex administration. Check the drug’s page on SingleCare; if it’s listed, the discount applies.

How often does SingleCare update its prices?

Prices are refreshed weekly based on pharmacy data feeds, so the discount you see today should be accurate for the next few weeks.

Is it worth keeping the card if I have a high‑deductible health plan?

Absolutely. Even with a high‑deductible plan, many people pay cash for certain meds. Adding a 30‑40% discount on top of the cash price can substantially lower out‑of‑pocket costs.

Whether you toss the card, keep it as a backup, or start using it for every refill, the key is to compare prices before you pay. A quick search on SingleCare (or a competitor) can turn a routine prescription into a noticeable saving.