NHS vs private healthcare: which is right for you?

Ever wonder why some people swear by the NHS while others pay for private care? The answer isn’t black and white. It comes down to money, speed, and how much control you want over your treatment. Let’s break down the facts so you can decide what fits your life.

What you really pay for

The NHS is billed as free, but only at the point of use. Prescription charges, dental check‑ups, eye tests and some specialist appointments still cost you. For many, a prescription is £9.35, a routine dental clean is around £30‑£60, and glasses can run a few hundred pounds.

Private health insurance (PHI) works the opposite way. You pay a monthly premium – anywhere from £30 to £200 depending on age, health and coverage – and the insurer covers most of the treatment costs. That premium often excludes pre‑existing conditions, certain cancers, or long‑term care, so you need to read the fine print.

If you’re healthy and don’t need frequent specialist care, the NHS can be cheaper overall. But if you have a chronic condition that needs regular scans or physiotherapy, the out‑of‑pocket NHS costs can add up fast, making PHI a smarter financial move.

How quickly you get treatment

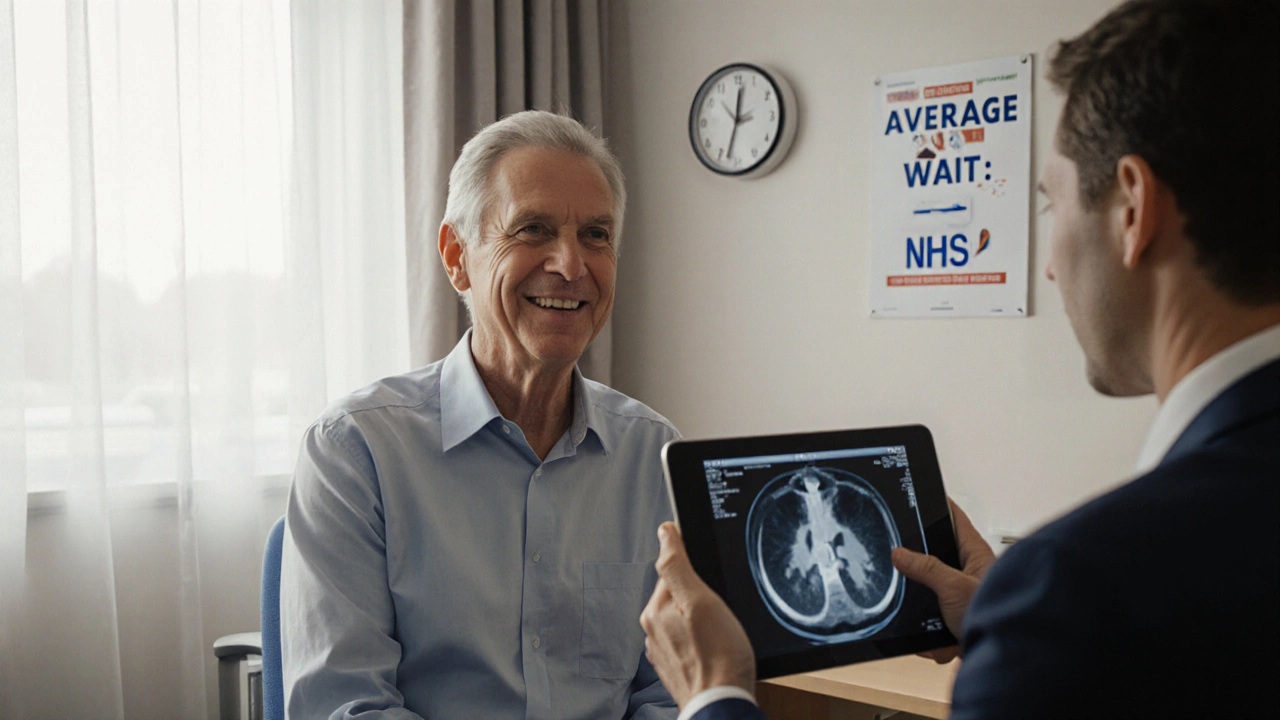

Waiting times are the biggest talking point. A routine MRI on the NHS might take 8‑12 weeks, while a private provider can schedule it within days. Same goes for elective surgeries – a hip replacement could be a year away on the NHS, but a private clinic often has slots within a month.Speed isn’t the only factor. With private care you usually get a named consultant, choose the hospital, and have a say over the appointment time. The NHS assigns you to the next available doctor, which can mean less continuity but also less hassle choosing a provider.

For emergencies, both systems converge – you’ll be treated in an NHS A&E regardless of your insurance. The real difference shines for non‑urgent, elective, or specialist services where time and choice matter.

So how do you pick?

Start by listing the treatments you expect in the next year. If you need a knee operation, a quick private slot might save you months of pain. If you only visit the GP a few times, stick with the NHS and keep a small fund for prescription fees.

Check your employer’s benefits. Many jobs include PHI as part of the package, which can lower your personal cost dramatically. If you’re self‑employed, compare policies – look for plans that cover the specialties you use most and offer no‑gap referrals.

Don’t forget the hybrid approach. Some people use the NHS for routine care and turn to private services for the occasional specialist visit. This can balance cost and speed without committing to full‑time insurance.

Finally, keep an eye on hidden expenses. Private clinics may charge extra for anaesthesia, physiotherapy after surgery, or follow‑up visits. The NHS includes most of these in the overall treatment, so factor them into your budgeting.

At the end of the day, the best choice is the one that matches your health needs, wallet, and how much control you want over appointments. Compare the real costs, think about waiting times, and decide whether a mix of NHS and private care gives you the safest, quickest path to feeling better.

Is it worth having private health insurance in the UK?

Private health insurance in the UK offers faster access to treatment but comes at a cost. Learn when it’s worth it, how much it costs, and what alternatives exist - without the hype.

Categories: Healthcare Insurance UK

0

Is Private Healthcare Worth It in the UK? Exploring the Benefits and Drawbacks

Private healthcare in the UK presents a host of benefits, including shorter wait times and increased access to specialists, but comes with its own set of considerations. With the National Health Service (NHS) being a backbone for many, understanding whether private healthcare insurance provides value requires evaluating cost, convenience, and the level of care. This article delves into the tangible advantages of private healthcare, contrasts it with the public system, and offers practical insights for potential policyholders. By examining real-world scenarios and expert opinions, we deliver a thorough look into whether private healthcare is a worthwhile investment for UK residents.

Categories: Healthcare Insurance UK

0