GoodRx vs Insurance: What Actually Saves You Money on Medications

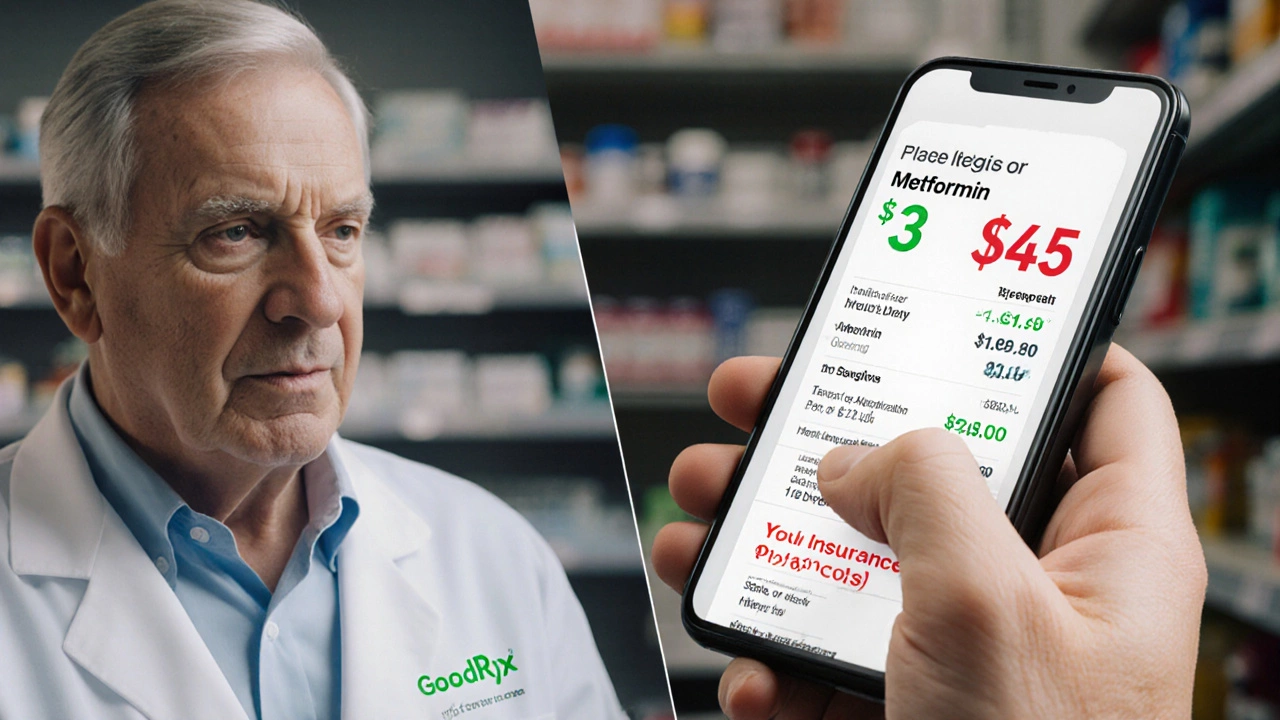

When you pick up a prescription, you might see two prices: one from your health insurance, a plan that covers part of your medical costs in exchange for monthly premiums and copays, and another from GoodRx, a free discount service that negotiates lower cash prices at pharmacies across the U.S.. The question isn’t which is better—it’s which one gives you the lowest price right now. Many people assume insurance always wins, but that’s not true. Sometimes, GoodRx cuts your bill in half, even if you’re insured. It’s not magic—it’s negotiation. GoodRx works with pharmacies to offer bulk discounts, and since they don’t involve insurers, there’s no deductible, no copay tiers, no formulary restrictions. You just show the coupon at the counter and pay less.

Here’s the catch: your insurance might not cover the drug at all, or it might require prior authorization, or your copay could be $75 because it’s a brand-name medication. Meanwhile, GoodRx might offer the same pill for $12. That’s not a fluke. A 2023 study from the Journal of the American Pharmacists Association found that GoodRx prices were lower than insurance copays in over 40% of cases for common prescriptions like metformin, lisinopril, and atorvastatin. And it’s not just for the uninsured. Even people with Medicare Part D, private insurance, or employer plans use GoodRx when the math adds up. The key is checking both before you pay. Some pharmacies let you ask for the GoodRx price even if you have insurance—you just have to request it. And if your insurance denies coverage, GoodRx becomes your lifeline. It’s also useful for medications not on your plan’s formulary, or if you’ve hit your annual out-of-pocket max. Unlike insurance, GoodRx doesn’t care how many times you fill a prescription. No limits. No paperwork. Just savings.

But GoodRx isn’t perfect. It doesn’t count toward your deductible or out-of-pocket maximum, so if you’re trying to meet those thresholds to unlock full coverage later in the year, paying cash with GoodRx won’t help. And it doesn’t cover specialty drugs or injectables that require a clinic or mail-order pharmacy. Still, for the millions of people paying full price or stuck with high copays, it’s a practical tool. Combine it with prescription discount cards, like SingleCare or RxSaver, which work similarly to GoodRx but may offer different deals at different locations, and you’ve got a powerful way to control medication costs. You don’t need to choose between GoodRx and insurance—you need to compare them every time. The system isn’t designed to make this easy, but you don’t have to accept it. Check your insurance copay, then check GoodRx. Pay the lower one. Simple. No apps. No contracts. Just your wallet and a phone.

Below, you’ll find real stories and breakdowns from people who’ve navigated this exact choice—how they saved hundreds on diabetes meds, why a $200 heart pill dropped to $18, and when skipping insurance made all the difference. These aren’t theoretical tips. These are real savings, real choices, and real people who figured it out.

What is the catch with GoodRx? The real truth about prescription savings

GoodRx isn't a scam, but it's not magic either. Learn how it works, when it saves you money, and why using it with insurance isn't allowed. Find out who benefits most and how to avoid the hidden traps.

Categories: Prescription Costs

0