GoodRx Savings Calculator

Compare your current prescription price with GoodRx cash prices to see if you'll save money.

GoodRx shows you prices as low as $5 for prescriptions that normally cost $100 or more. It feels like magic-until you start asking: What is the catch with GoodRx? The truth isn’t hidden. It’s just buried under marketing noise. You’re not being scammed. But you’re not getting free money either. Here’s what actually happens when you use GoodRx.

How GoodRx Works (Without the Fluff)

GoodRx doesn’t sell drugs. It doesn’t own pharmacies. It doesn’t even have a pharmacy license. What it does is act like a price comparison engine for prescriptions. It gathers data from pharmacy benefit managers (PBMs)-the middlemen between drug makers, insurers, and pharmacies-and shows you the lowest cash price available at nearby pharmacies.

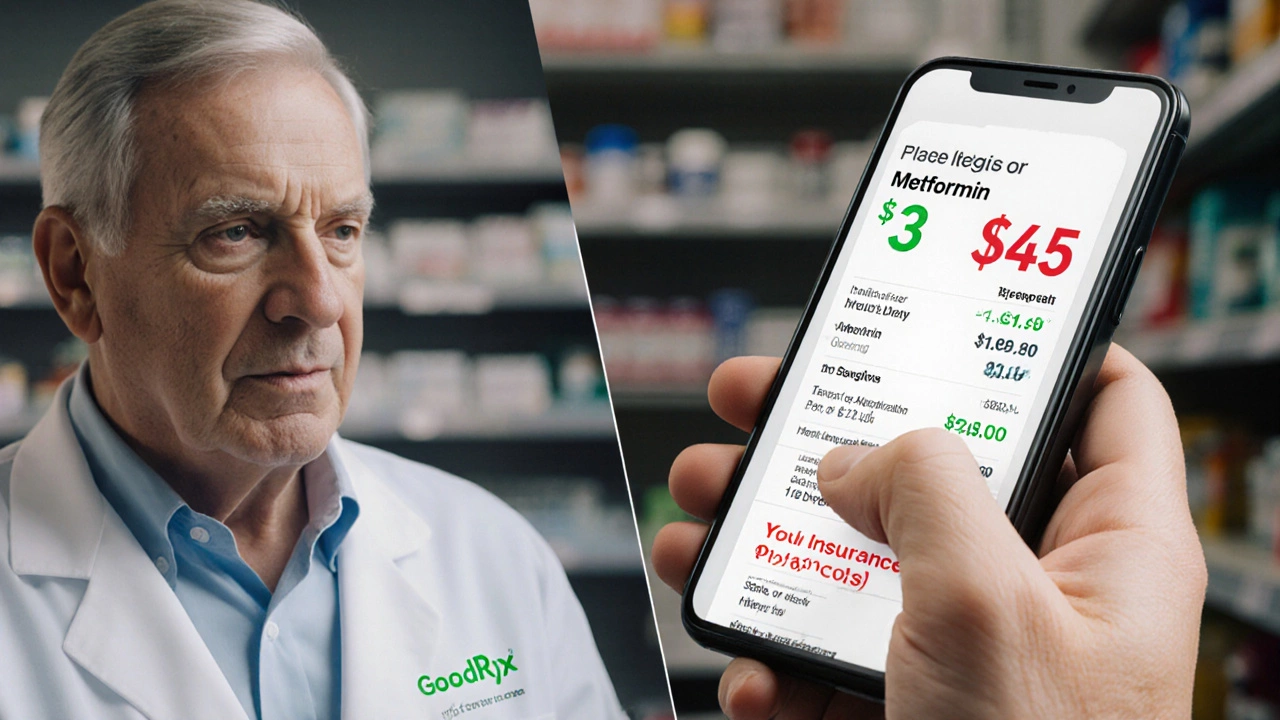

When you search for, say, metformin, GoodRx pulls up prices from CVS, Walgreens, Rite Aid, and local independents. One might charge $12. Another might charge $4. You pick the lowest, show the coupon at the counter, and pay cash. That’s it.

GoodRx makes money by taking a small fee from the pharmacy when you use their coupon. The pharmacy pays them because they’d rather get $4 from you than nothing at all. For them, it’s better than having you walk out because the price was too high.

The Real Catch: You Can’t Use It With Insurance

This is the big one. You can’t combine GoodRx with your insurance. Not even a little bit. If you’re on Medicare Part D, Medicaid, or a private plan, you have to choose: use your insurance or use GoodRx.

That’s not a glitch. It’s by design. Insurance companies negotiate their own prices with PBMs. Those prices are confidential. GoodRx only shows you the cash prices-the ones outside the insurance system.

So here’s the problem: sometimes your insurance price is lower than GoodRx. Other times, GoodRx is way cheaper. You won’t know unless you check both. And most people don’t. They assume insurance always wins. It doesn’t.

For example, a 30-day supply of lisinopril might cost $18 with Medicare Part D. But with GoodRx, you can get it for $3 at Walmart. That’s an 83% savings. But if you’re on a high-deductible plan and haven’t met your deductible yet, your out-of-pocket might be $45. In that case, GoodRx saves you $42.

Why Some Prescriptions Are Crazy Cheap on GoodRx

Ever wonder why some drugs are $2 on GoodRx but $80 at the pharmacy without it? It’s because of how drug pricing works in the U.S.

Drug manufacturers give discounts to PBMs in exchange for being listed on their preferred drug lists. These PBMs then pass some of that discount along to GoodRx. But they don’t pass it to your insurance plan. Insurance plans get their own negotiated rates, which are often higher than the cash price because they include administrative fees, rebates, and hidden markups.

GoodRx shows you the price the pharmacy actually pays after the PBM discount. That’s why you see $3 for a drug that’s priced at $120 on your insurance statement. The insurance system is built to hide the real cost. GoodRx exposes it.

Who Benefits Most From GoodRx?

You’re most likely to save big with GoodRx if you:

- Don’t have insurance

- Have a high-deductible health plan

- Pay cash for prescriptions

- Take generic drugs (not brand-name)

- Live in a state with high drug prices (like California or Florida)

Medicare Part D users often save the most. Many seniors don’t realize their plan’s copay isn’t the lowest price available. GoodRx can cut their monthly costs by half or more.

But if you’re on Medicaid, you usually can’t use GoodRx at all. Medicaid already has state-negotiated prices that are lower than most cash rates. GoodRx won’t help you there.

The Hidden Downsides

GoodRx isn’t perfect. Here’s what you might run into:

- Not all pharmacies accept it. Some independent pharmacies refuse to honor GoodRx coupons because they lose money on them. You might drive to three stores before finding one that accepts it.

- Prices change daily. A $4 price today might be $12 tomorrow. You have to check every time you refill.

- Some drugs aren’t discounted. Newer drugs, specialty meds, or those without generic alternatives often have no GoodRx deal.

- It doesn’t build credit toward your deductible. If you’re on a high-deductible plan, paying with GoodRx means that money doesn’t count toward your deductible or out-of-pocket maximum. You’re paying cash, not using insurance benefits.

There’s also a psychological trap. People see a $3 price and assume it’s a deal. But if you’re paying $3 because you’re not using insurance, you might be missing out on future coverage. For example, if you’re paying $3 for your blood pressure med every month, you’re not helping your deductible reset. Next year, when your plan changes, you could end up paying more.

When GoodRx Is a Trap

GoodRx isn’t a scam-but it can be a trap if you use it blindly.

Example: You’re on a Medicare Advantage plan that covers insulin at $35/month. You see GoodRx showing $10 for the same insulin. You switch. You save $25. Great, right?

But your plan’s $35 includes other benefits: free delivery, no prior authorization, access to a pharmacist for questions, and automatic refills. GoodRx gives you nothing else. If you need help understanding your meds, you’re on your own. If you forget to refill, you’re out of stock. No reminders. No support.

Also, if your plan changes next year and drops that $35 insulin benefit, you’ll be stuck paying full cash price-possibly $100+-because you never built up insurance coverage.

How to Use GoodRx Without Getting Screwed

Here’s how to use GoodRx the smart way:

- Always check your insurance price first. Call your pharmacy or log into your plan’s portal.

- Then check GoodRx. Compare the cash price.

- Use the lower of the two.

- Don’t assume GoodRx is always better. Sometimes it’s not.

- For chronic meds, set a monthly reminder to recheck prices. They change often.

- Use GoodRx for generics only. Brand-name drugs rarely have good deals.

- Don’t use it if you’re on Medicaid or VA benefits-they already have the best prices.

Pro tip: Download the GoodRx app. It’ll alert you when prices drop. It’ll also show you which pharmacies are closest and how much you’ll save. It’s free. Use it like a price tracker-not a magic wand.

What About GoodRx Gold?

GoodRx Gold is a $10/month subscription that promises even lower prices. Is it worth it?

Only if you take at least three prescriptions a month and the savings add up to more than $10. For most people, it’s not. The free version already gives you the same discounts. Gold just adds a few extra cents off a few drugs. You’re better off sticking with free GoodRx unless you’re on a complex regimen.

Bottom Line: No Magic, Just Math

There’s no catch. GoodRx doesn’t hide fees. It doesn’t steal your data. It doesn’t overcharge you. It just shows you the truth: the U.S. prescription system is broken. Prices are wildly inconsistent. Insurance doesn’t always save you money. Cash can be cheaper.

GoodRx is a tool. Like a flashlight in a dark room. It doesn’t fix the room. It just helps you see what’s there.

If you’re paying full price for prescriptions without checking, you’re leaving money on the table. Use GoodRx. Compare. Save. But never stop asking: Is this really the best price?

Can I use GoodRx with Medicare?

Yes, you can use GoodRx with Medicare, but only if you choose to pay cash instead of using your Medicare Part D plan. Medicare Part D has negotiated prices, but sometimes GoodRx offers lower cash prices-especially for generics. You can’t combine them. You must pick one. Check both prices before paying.

Why is GoodRx cheaper than my insurance?

Insurance plans pay negotiated rates that include administrative fees, rebates, and markups. GoodRx shows you the cash price pharmacies pay after discounts from pharmacy benefit managers (PBMs). Those cash prices are often lower because they’re not tied to insurance overhead. The system is designed to hide the real cost-GoodRx exposes it.

Does GoodRx work for brand-name drugs?

Rarely. GoodRx deals are mostly for generic drugs. Brand-name drugs like Humira or Ozempic rarely have cash discounts because manufacturers don’t offer rebates to PBMs for those. If you see a GoodRx price for a brand-name drug, it’s usually close to the retail price-not a discount.

Is GoodRx safe to use?

Yes. GoodRx doesn’t handle your personal health data. It doesn’t store your prescriptions or insurance info. You just show a coupon at the pharmacy. The pharmacy fills your prescription the same way they would with insurance. No risk to your medical records.

What if my pharmacy won’t accept GoodRx?

Some pharmacies, especially independents, refuse GoodRx coupons because they lose money on them. Try another location-GoodRx shows you multiple nearby options. Chain pharmacies like Walmart, Costco, and Kroger almost always accept it. If you’re having trouble, call ahead and ask if they honor GoodRx coupons.