UK Private Health Insurance Cost Estimator

Estimated Annual Premium:

Enter your details and click "Estimate My Premium"

Monthly Equivalent:

-

Ever wondered how much a Brit actually shells out for private health cover? The answer isn’t a single number - it shifts with age, where you live, and how much you want covered. This guide breaks down the latest 2025 data, shows where the money goes, and gives you a quick way to estimate your own bill.

What "British health insurance" really means

British health insurance is a private medical coverage purchased by individuals or families in the United Kingdom to supplement the publicly funded National Health Service (NHS). It typically covers faster access to specialists, elective procedures, and a broader choice of hospitals. While the NHS provides free treatment at the point of use, private policies let you bypass queues and often include extra services like dental or physiotherapy.

How the NHS fits into the picture

National Health Service (NHS) is the UK's universal health system funded through taxation. It delivers most essential services, but waiting times can stretch weeks or months for non‑emergency care. That's why many Britons add private cover - not to replace the NHS, but to speed up access and widen options.

Key factors that shape your premium

Three big drivers decide what you’ll pay each month:

- Age band: insurers view older policyholders as higher risk, so premiums climb sharply after 50.

- Geographic region: London and the South East command higher rates because hospital fees are steeper there.

- Coverage level: A basic plan covering only inpatient stays costs far less than a comprehensive package that adds outpatient, dental, and mental‑health benefits.

Other tweaks - like adding a spouse, opting for a higher deductible or selecting a specific private health insurer - also shift the final figure.

Average annual premiums by age (2025)

| Age Range | Basic Plan (£) | Standard Plan (£) | Comprehensive Plan (£) |

|---|---|---|---|

| 18‑30 | 400 | 720 | 1,150 |

| 31‑40 | 540 | 950 | 1,420 |

| 41‑50 | 770 | 1,350 | 2,080 |

| 51‑60 | 1,130 | 2,050 | 3,200 |

| 61+ | 1,890 | 3,600 | 5,400 |

These numbers come from the Association of British Insurers (ABI) and reflect the most common policies sold by top providers such as Bupa, AXA PPP, and Vitality.

Family and joint policies

If you’re covering a spouse and kids, insurers often bundle the cost. A typical family of four (two adults, two children) pays about 30‑40% more than two separate individual plans, thanks to shared administrative fees.

- Average family annual premium (basic) - £2,850

- Average family annual premium (standard) - £4,600

- Average family annual premium (comprehensive) - £7,100

Adding a teenage child usually bumps the premium by £150‑£250, while a senior parent can add £500‑£800.

Cheapest and most expensive providers (2025 snapshot)

Below is a quick look at where the market stands. Prices are based on an average 35‑year‑old male opting for a standard plan with a £500 deductible.

| Provider | Annual Premium (£) | Key Offering |

|---|---|---|

| Direct Line Health | 820 | Fast‑track GP appointments |

| Simplyhealth | 845 | Dental and optical add‑on |

| Bupa (basic tier) | 920 | Wide hospital network |

| AXA PPP (premium tier) | 1,470 | Private rooms & concierge |

| Vitality (elite) | 1,620 | Wellness incentives + global cover |

Cheapest options generally limit you to a core set of hospitals and exclude private rooms. The pricier plans throw in perks like fitness‑tracker reimbursements and worldwide emergency coverage.

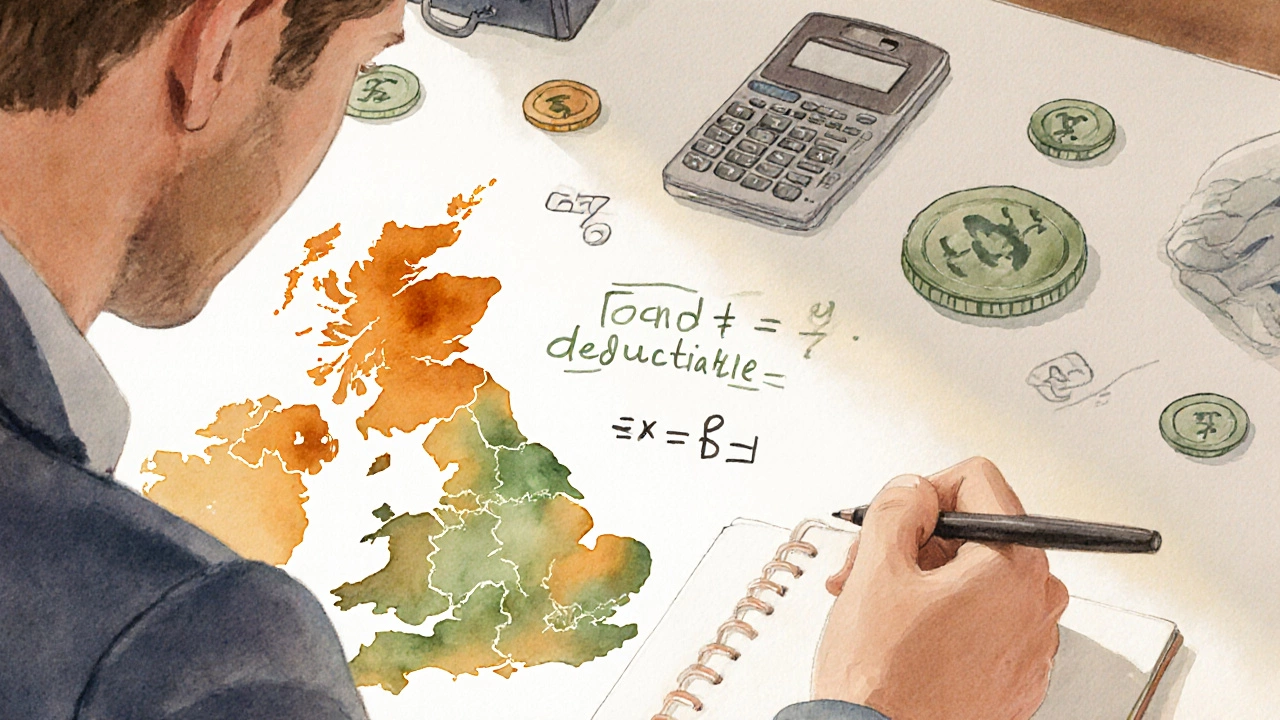

How to estimate your own cost in minutes

- Identify your policyholder age and any dependents.

- Pick a coverage level - basic, standard, or comprehensive.

- Decide on a deductible: higher (£1,000‑£2,000) lowers premium, lower (£0‑£250) raises it.

- Choose a region - use the table above to add the regional multiplier (London+15%, Scotland-5%).

- Plug the numbers into this simple formula:

Estimated Premium = Base Rate × Age Factor × Region Factor ÷ (Deductible ÷ 250)

For example, a 45‑year‑old living in Manchester, opting for a standard plan with a £500 deductible, would calculate roughly:

- Base Rate (standard, 40‑50 age band) = £1,350

- Age Factor (45) ≈ 1.0 (mid‑range)

- Region Factor (Manchester) = 1.00

- Deductible adjustment = 500/250 = 2 → divide by 2

Result: £1,350 ÷ 2 ≈ £675 per year.

Common pitfalls to avoid

- Skipping the fine print. Some policies cap outpatient reimbursements at £5,000, which can bite if you need frequent physiotherapy.

- Assuming the NHS will cover everything. Private cover only speeds up care; it doesn’t replace NHS emergency services.

- Choosing the cheapest plan but forgetting the deductible. A low premium with a £2,000 deductible can cost you more in the long run.

- Neglecting regional price differences. A plan that’s cheap in Wales might be 20% pricier in London.

Quick recap of the numbers

- Average individual premium (2025): £720-£2,080 depending on age and plan.

- Family of four: roughly £4,600 for a standard policy.

- Cheapest mainstream providers start around £820 per year.

- High‑end elite plans can exceed £1,600 annually.

Frequently Asked Questions

Do I still need private health insurance if I use the NHS?

Yes. Private cover doesn’t replace NHS services; it gives you faster access, more hospital choice, and often extra benefits like dental or mental‑health support.

Can I claim NHS treatment costs on my private policy?

Most policies exclude NHS‑provided care, but some premium plans will reimburse a portion of NHS‑treated procedures if you later opt for private follow‑up. Check the policy wording.

What happens if I move from England to Scotland?

Your premium may drop by 5‑10% because hospital costs are generally lower in Scotland. Contact your insurer to request a regional adjustment.

Is there a tax advantage to buying private health insurance?

No direct tax relief exists for private health cover, but many employers offer it as a salary‑sacrificed benefit, which reduces your taxable income.

How often can I change my plan during the year?

Most insurers allow one mid‑year adjustment (often in June) without penalty, provided you stay within the same coverage tier.