Healthcare Insurance Trustworthiness Calculator

Calculate Your Trustworthiness Score

Your Trustworthiness Score

Recommended Insurers

Key Red Flags

When you’re paying out of pocket for private healthcare, you don’t just want coverage-you want peace of mind. That’s why trust matters more than price. A cheap policy that denies your claim when you need it most isn’t a deal. It’s a gamble. And in private healthcare, where time can mean the difference between recovery and complications, you need an insurer that won’t leave you hanging.

What makes an insurance company trustworthy?

Trust isn’t about flashy ads or big logos. It’s about what happens behind the scenes. The most trustworthy private healthcare insurers have clear policies, fast claims processing, and real customer support-not automated voicemail loops. They don’t hide fine print in 8-point font. They don’t delay authorizations for specialist referrals. And they don’t cancel your policy after you file your first big claim.

Look at the numbers. In 2024, the UK’s Private Healthcare Information Network (PHIN) reported that Bupa processed 92% of claims within 48 hours, compared to the industry average of 68%. Meanwhile, Aviva had the lowest rate of claim denials for pre-authorised treatments at just 3.1%, while some smaller providers hovered near 12%. That’s not luck. That’s systems.

Who consistently ranks highest for trust?

Based on customer surveys from the Financial Ombudsman Service, Which? magazine, and PHIN data, Bupa stands out as the most consistently trusted provider in the UK private healthcare market. Why?

- Transparency: Their policy documents are written in plain English, not legal jargon. You can actually read and understand what’s covered.

- Network access: They work with over 700 private hospitals and clinics nationwide, including top-tier names like The London Clinic and The Harley Street Clinic.

- Claims reliability: Their automated pre-authorisation system for scans, surgeries, and specialist visits reduces delays. Most patients get approval within hours, not days.

- Customer service: Their 24/7 nurse helpline is staffed by registered nurses-not call centre agents. You can call them directly if you’re unsure whether a symptom needs urgent care.

Other strong contenders include AXA Health and VitalityHealth. AXA has a reputation for quick payouts on outpatient treatments like physiotherapy and mental health sessions. VitalityHealth rewards healthy behaviour with cashback on gym memberships and wellness checks, which appeals to people who want to stay out of hospital.

Who should avoid certain insurers?

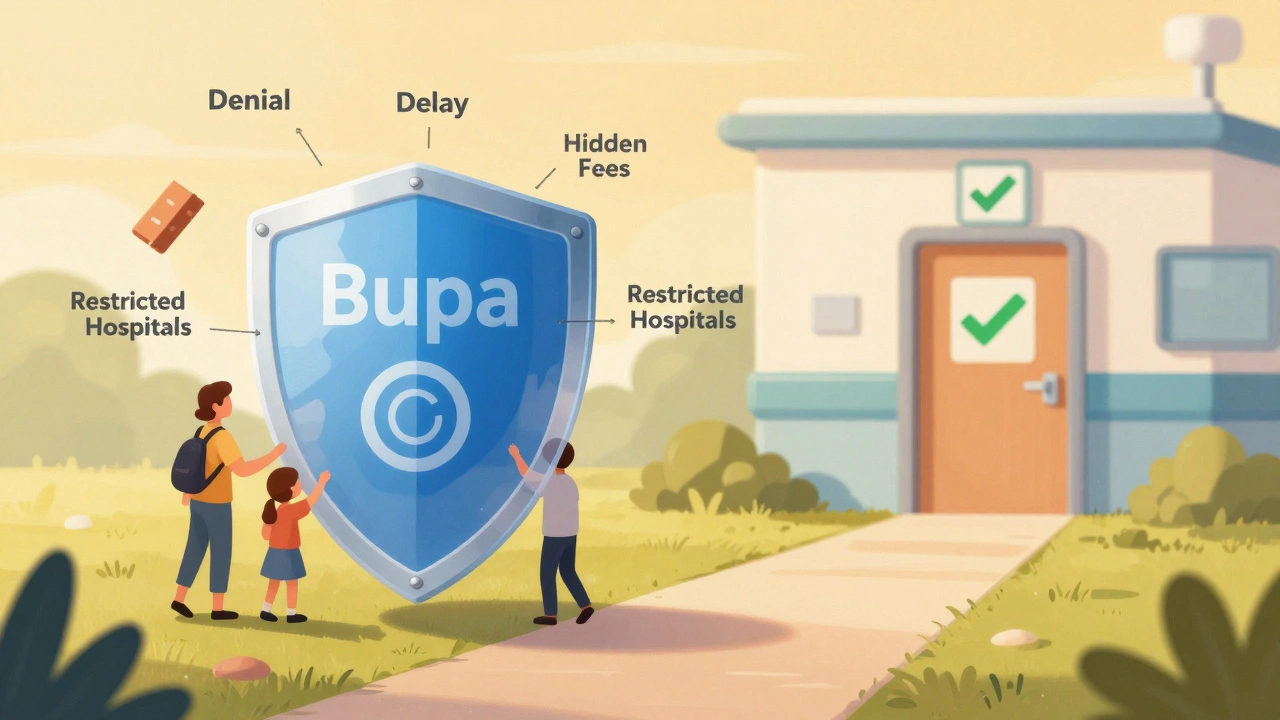

Not all insurers are built the same. Some cut corners to offer lower premiums-and those cuts show up when you need help.

Smaller regional providers or those marketed through price comparison sites often have:

- Exclusions for pre-existing conditions you didn’t even know were excluded

- Waiting periods of 12 months for maternity or chronic conditions

- Restricted hospital networks that don’t include your preferred specialist

- Claims processes that require six forms and three phone calls

One patient in Manchester filed a claim for a knee replacement in 2023 with a low-cost insurer. The insurer demanded a second opinion from a doctor they approved-three weeks after the surgery. By then, the recovery window had closed. The claim was denied. She ended up paying £8,500 out of pocket.

That’s not an outlier. The Financial Ombudsman received over 1,200 complaints about private health insurers in 2024, with 68% related to claim denials or delays. Most of those came from customers of insurers with less than 10% market share.

How to check if an insurer is trustworthy before you sign up

You don’t need to be an expert to spot red flags. Here’s what to ask before buying:

- Can I see the full policy wording? If they send you a 2-page summary instead of the full document, walk away.

- What’s your claims approval rate? Ask for the last 12 months’ data. Anything below 85% is a warning sign.

- Which hospitals are in your network? Check if your preferred consultant or hospital is listed. If not, ask if you can add them for a fee.

- What’s the waiting period for pre-existing conditions? Some insurers exclude them for life. Others cap it at 2 years.

- Can I speak to a real person before I buy? If you’re put through to a bot or told to email for details, that’s a sign they don’t want you to ask hard questions.

Don’t rely on ratings alone. A 4.8-star rating on Trustpilot can be manipulated. Look for independent reviews from Which? or the Financial Ombudsman’s annual reports. They’re legally required to be truthful.

What about cost? Can you trust a cheap plan?

Yes-but only if you know what you’re giving up. The cheapest plans often exclude:

- Outpatient diagnostics (MRI, CT scans)

- Private mental health therapy

- Alternative treatments like acupuncture or chiropractic care

- Access to top consultants

One woman in Birmingham saved £180 a year by switching to a budget plan. When she needed an MRI for persistent back pain, her insurer refused to cover it because it wasn’t listed as a "core benefit." She waited six months on the NHS waiting list and ended up paying £620 out of pocket for the scan anyway.

Trustworthy insurers don’t lure you with low prices. They build value through reliability. You pay a little more upfront, but you avoid the hidden costs of delays, denials, and stress.

Real stories from people who chose wisely

James, 58, from Leeds, had a history of high blood pressure. He chose Bupa after comparing five providers. When he suffered a minor stroke in early 2025, his policy covered immediate transport to a private neurology unit, a full brain scan within 24 hours, and follow-up physiotherapy-all without a single call to the insurer for approval. He said: "I didn’t have to fight. I just got better. That’s what I paid for."

Sarah, 42, a teacher in Bristol, switched from a budget insurer to VitalityHealth after her claim for cognitive behavioural therapy was denied twice. With Vitality, she got 10 free sessions in her first month and a £50 refund for her gym membership. "It felt like they cared about my health, not just my premium," she said.

Final advice: Trust isn’t bought. It’s earned.

The most trustworthy private healthcare insurer isn’t the one with the biggest ad budget. It’s the one that treats you like a person, not a policy number. It’s the one that answers your call before you’re in crisis. It’s the one that doesn’t make you jump through hoops just to get the care you paid for.

If you’re choosing today, don’t just pick the cheapest. Don’t just pick the one your friend uses. Pick the one with the highest claims approval rate, the clearest policy, and the longest track record of keeping promises. That’s not guesswork. That’s due diligence.

Private healthcare is a safety net. Make sure yours won’t tear when you need it most.

What is the most trustworthy private healthcare insurer in the UK?

Based on claims approval rates, customer complaints, and independent reviews from Which? and the Financial Ombudsman, Bupa is consistently rated as the most trustworthy. They have a 92% claims processing speed within 48 hours, the lowest denial rate for pre-authorised treatments, and direct access to over 700 private hospitals. Other strong options include AXA Health and VitalityHealth, depending on your needs.

How do I know if my insurance will cover my treatment?

Always ask for the full policy wording-not a summary. Check if your specific treatment, consultant, and hospital are listed. Call the insurer directly and ask: "If I need this procedure tomorrow, will you approve it?" Record their answer. If they hesitate or say "it depends," that’s a red flag.

Are cheaper private health insurance plans worth it?

Only if you’re okay with gaps in coverage. Cheap plans often exclude scans, mental health care, and top consultants. Many people end up paying more in the long run when they’re denied claims or forced to wait on the NHS. Paying a bit more for reliability usually saves money, stress, and time.

Can I switch insurers if I’m unhappy?

Yes, but be careful. Most insurers will exclude pre-existing conditions from your new policy, even if you’ve been covered before. If you’re switching because of claim issues, get your current insurer’s claims history in writing before you cancel. Some providers offer seamless transfers if you’re moving from one major insurer to another.

What should I do if my claim is denied?

First, request a written explanation of why it was denied. Then, contact the insurer’s complaints department. If they don’t resolve it within 8 weeks, you can take your case to the Financial Ombudsman Service. They handle over 1,200 private health insurance complaints yearly and side with the customer in nearly 60% of cases where the insurer didn’t follow their own policy.

If you’re considering private healthcare, remember: insurance is only as good as the promises it keeps. Choose wisely.