If you’ve ever opened a medical bill and thought, "Wait, wasn’t this supposed to be covered?" you’re in good company. The $2000 Medicare cap is one of those policies that sounds simple, but peels back to reveal a maze of rules and exceptions. It’s been sparking debates and changing how people approach their healthcare from Bondi to Broome. But what exactly does it mean for your wallet, your family, and your next doctor’s visit? Let’s unpack the real impact—and the hidden details Australians need to watch for.

Decoding the $2000 Medicare Cap: What It Is and Why It Exists

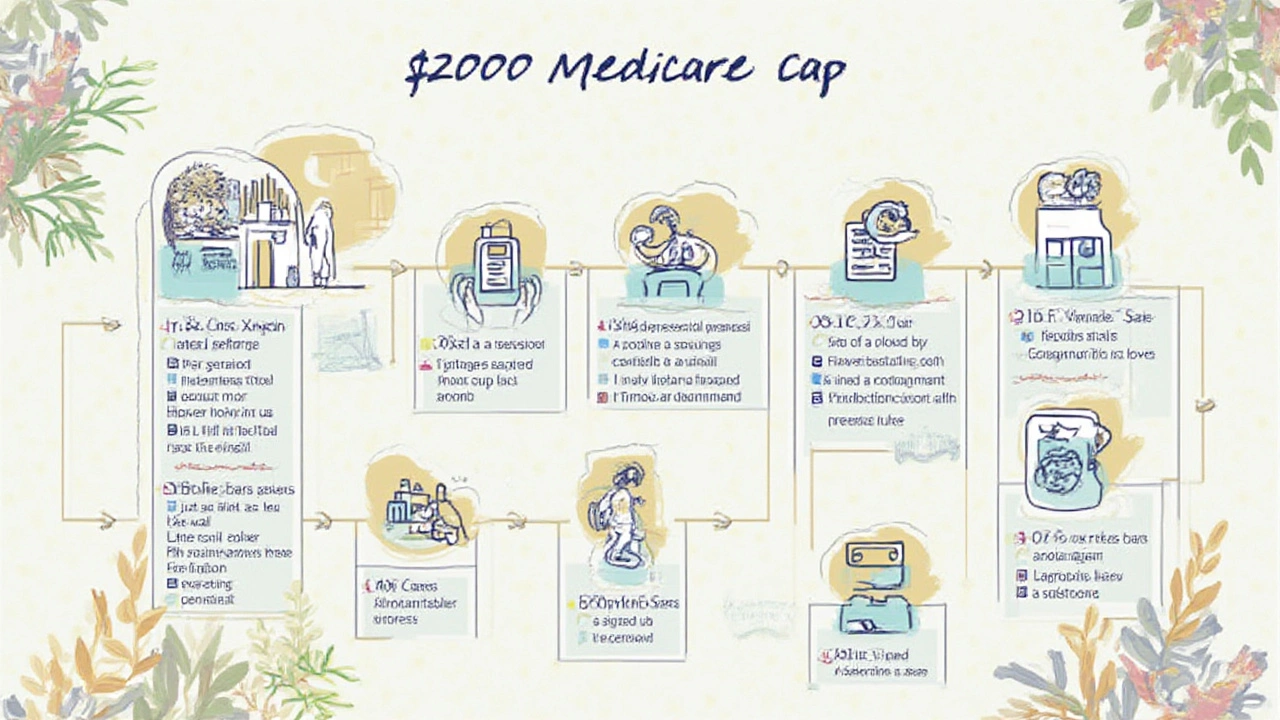

The $2000 Medicare cap is a threshold set by the Australian government to limit how much patients can claim on certain out-of-hospital medical services in a given year. Specifically, it applies to allied health services—think physiotherapy, psychology, podiatry, and other extras that don’t happen in a hospital. The idea is to address ballooning costs while making sure Medicare remains sustainable for everyone. But honestly, the fine print makes people scratch their heads. Why not just cover everything? Because healthcare’s price tag keeps climbing, and someone has to foot the bill—either the government (and taxpayers) or the patients themselves. This cap first came to public attention in 2023, after a steady rise in Medicare spending had Canberra hunting for smarter ways to stretch the budget. Back then, the Health Minister said,

“This cap is about making sure Medicare keeps working for the Australians who need it most, while protecting the system for generations to come.”

But while the goal sounds noble, everyday Australians often don’t realise they’re approaching the cap until an invoice lands with a sting. The $2000 figure is assessed per individual, per year. Once you hit it, you’ll start paying full price for further allied health services until the new year kicks in. It’s not a lifetime limit, and it resets every July 1st, lining up with the new financial year. But there’s a catch: not every service counts towards it, and some item numbers loop through exceptions.

How Does the Cap Actually Work? The Mechanics and the Maths

Here’s where the rubber hits the road. Say you see a physio for rehab, a psychologist for stress, and a podiatrist for that never-ending heel pain, all in the same year. Medicare chips in for part of each visit, up to the $2000 mark. Once the capped total of rebates reaches this limit, Medicare says, "We’re out," and you’re expected to cover everything else for the year. The whole process hinges on tracking—in most cases, your providers plug claims straight into Medicare’s system, so the running tally updates automatically. But not all clinics have the same digital savvy. It’s worth asking your practitioner, "How close am I to this year’s cap?"

The $2000 refers to combined rebates, not the out-of-pocket costs. For example, if you pay $100 for a session and Medicare covers $58, only that $58 goes towards your cap. That means your actual spending could be much higher before you hit the ceiling. A quick napkin calculation: reaching the cap could mean getting about 34 physio visits (if each earns a $58 rebate) or fewer if visiting providers with higher eligible rebates. Of course, actual rebates change depending on the service and your particular Medicare plan, so the number of visits covered varies widely.

Here’s a table to give you an at-a-glance view of how quickly you could reach the cap across common allied health services:

| Service | Average Medicare Rebate Per Visit | Estimated Visits Before Cap |

|---|---|---|

| Physiotherapy | $58 | 34 |

| Psychology | $93 | 21 |

| Podiatry | $54 | 37 |

It’s not a free-for-all—Medicare only pays up to a pre-set rebate for each service, and private health insurance doesn’t boost the cap amount. Family groups aren’t pooled together for this cap: everyone’s counted separately. And, to make things more complex, some chronic or long-term care plans come with their own unique rules and thresholds. So, it’s possible to get blindsided.

Who’s Affected? Sorting Out Who Needs to Care

Not everyone in Australia feels the burn of this cap. If you rarely visit an allied health provider, you might never even brush up against the $2000 mark. But if you or your family live with ongoing health needs—chronic pain, mental health conditions, rehab after surgery—the chances rise fast. Kids with developmental delays and elderly folks with complex care needs are two groups most likely to hit the cap before the year is up.

Healthcare providers are very aware of it. Some will even warn you if you’re getting close. But the system isn’t always clear. Unlike your credit card that buzzes an alert, Medicare doesn’t shoot you a text when you cross the line. If you juggle several providers—say a speech pathologist, psychologist, and OT all working with your child’s NDIS plan—those rebates add up without much warning. Plus, the cap doesn’t factor in how vital or urgent the service is—once you’re over, you’re over, no matter the reason.

Aboriginal and Torres Strait Islander Australians, people in regional areas, and lower-income families are often hit hardest by these caps. Many in these groups rely heavily on publicly funded allied health. There have been calls to review how the cap applies based on need, but so far, it’s a blanket rule that leaves little wiggle room.

Navigating the Cap: Tips to Make Your Money Go Further

Don’t want to end the year with a surprise bill? Stay proactive. First, check your claim history regularly by logging onto your MyGov Medicare account. Everything’s listed there—including how much of your $2000 cap is already spent. Keep your receipts, and ask your providers to clarify billing codes, so you’re sure the right claims are getting logged.

Talk to your GP about putting a care plan in place if you have a chronic condition. Some care plans unlock extra Medicare-supported sessions that operate alongside the cap but with dedicated limits—like five extra physio visits. Also, make sure your providers are registered and billing correctly. Mistakes happen, and an incorrectly coded visit won’t count towards the cap (or could eat up your limit too quickly).

If you know you’ll need lots of sessions in a year, try to spread them out to avoid burning through your cap too soon. Or consider blending Medicare-funded sessions with private health benefits, if you have them, to reduce reliance on one safety net. Some people plan double appointments earlier in the year, giving time to save up if they start hitting the ceiling mid-year. Another hot tip? Ask your providers if they’re aware of community programs, as local councils or not-for-profits sometimes offer free or low-cost allied health outside of Medicare caps. Don’t be shy—your physio or psych has probably heard it all before.

A 2024 Health Consumers NSW report suggested that nearly 18% of people who needed regular allied health ended up delaying or cancelling care because of rebate limits. That’s no small worry if you’re managing a condition that needs continuity, so talk openly with your team about the best way to stretch your sessions—before the cap gets in the way.

For those who need it, some community health centres provide sliding scale fees. You could even talk to your provider about longer but less frequent appointments to get more value. And definitely get clear on costs before you book, so nothing sneaks up on you.

The Future of the 00 Cap: Ongoing Debate and What to Watch

The $2000 Medicare cap has added fuel to Australia’s never-ending debate about health funding. Critics argue that limits like these force people to cut back on needed care, with a knock-on effect on long-term health and public costs. Some professional bodies are pushing for higher caps, exemptions for the vulnerable, or a total rethink. The current government has hinted at reviews but nothing firm has changed in 2025. Meanwhile, the reality is, the cap stays—and so do the tricky choices it forces on families.

Don’t expect the number to go away soon. Treasury figures show allied health costs have been rising more than 4% per year since 2020, and there’s no sign that’s slowing. With Australia’s population ageing, and chronic conditions on the rise, policymakers will keep playing tug-of-war between budgets and patient needs. One possible move is to increase the cap, but even that wouldn’t fix the uneven impact across communities.

Here’s the raw truth: the Medicare $2000 cap may not make sense for everyone, but right now, it’s part of the landscape. By staying informed, asking the right questions, and using a few smart tricks to manage your care, you can take some of the sting out. The bottom line? Don’t be afraid to push for clarity with every provider and check your numbers before you book. Around here, most people agree: if you’re not confused by a government health rule, you probably haven’t read the fine print yet.