Health Insurance in the UK – What You Need to Know Today

If you’ve ever wondered whether you really need health insurance in the UK, you’re not alone. The NHS gives most people free care at the point of use, but there are hidden costs, long waits, and services the NHS doesn’t fully cover. That’s where private health insurance, also known as PMI, steps in. In this guide we break down the basics, compare NHS and private options, and give you practical advice on when buying a policy makes sense.

Why Think About Private Health Insurance?

Most UK residents rely on the NHS for routine appointments, emergencies, and most hospital stays. However, private insurance can shave waiting times, give you a choice of specialists, and cover treatments like physiotherapy, mental health therapy, and dental work that the NHS often leaves out. If you have a busy schedule, a chronic condition, or simply hate waiting months for an MRI, a private plan can be a real time‑saver.

Cost is another factor. A typical PMI policy in 2025 runs between £30 and £150 a month, depending on age, health status, and the level of cover. While that sounds like a lot, many people find the extra speed and choice worth the price, especially if they can claim the premium through a workplace scheme.

When the NHS Is Still Your Best Bet

Don’t discount the NHS just because private insurance exists. For most everyday illnesses and injuries, the NHS provides high‑quality care at no direct cost. Prescription charges are modest (£9.35 per item for most adults), and there are exemptions for seniors, low‑income households, and certain medical conditions. If you’re generally healthy and don’t need frequent specialist visits, sticking with the NHS can save you hundreds of pounds a year.

Keep an eye on waiting lists, though. In 2024, average waits for non‑urgent orthopaedic surgery topped 12 weeks. If you can tolerate that timeframe, you might not need a private plan. Also, remember that the NHS covers emergency care nationwide—something private insurance can’t guarantee if you travel abroad.

So, how do you decide? Ask yourself three quick questions:

- Do I need faster access to specialists or diagnostics?

- Do I have ongoing health issues that the NHS doesn’t fully cover?

- Can I afford the monthly premium without hurting my budget?

If you answered “yes” to any of these, it’s worth shopping around for a policy.

When looking at plans, compare what’s covered (in‑patient, out‑patient, dental, optical, mental health), the excess you’ll pay for each claim, and any exclusions for pre‑existing conditions. Some insurers also offer cashback or wellness rewards that can offset the cost.

Finally, remember that health insurance isn’t a one‑size‑fits‑all product. You can start with a basic hospital‑only plan and add extras like physiotherapy or mental health coverage later. Many providers let you adjust the level of cover every year, so you can scale up or down as your needs change.

Bottom line: the NHS is a solid foundation, but private health insurance can fill gaps, cut waiting times, and give you more control over your care. Weigh the costs, think about your health history, and pick a plan that matches your lifestyle. With the right information, you’ll make a choice that keeps you healthy without breaking the bank.

What If You Can't Afford Surgery? Practical Ways to Cover the Cost

Learn how to cover surgery expenses without cash: explore insurance, government aid, loans, charities, and crowdfunding, plus step‑by‑step tips and a comparison table.

Categories: Healthcare Advice

0

PPO vs HMO: Which Health Insurance Plan Suits You Best?

Trying to decide between a PPO and an HMO? Learn how these health insurance plans work, their main differences, and real-life examples to help make your choice easier.

Categories: Healthcare Advice

0

Is It Cheaper to Skip Health Insurance in the US?

Wondering if dropping health insurance in the US could save you money? This article unpacks what actually happens when you go uninsured—how expenses stack up, who might take the risk, and the hidden costs that catch many people off guard. Expect real-life tips on budgeting for medical care and what options exist when you’re flying solo. You’ll also get the lowdown on urgent care, hospital bills, and what could drain your savings without insurance. The reality might surprise you.

Categories: Private Healthcare

0

Medicare $170 Monthly Premium: Who Really Has to Pay?

Wondering if everyone really pays $170 a month for Medicare? This article breaks down who actually pays this premium, who doesn’t, and why the amount isn't set in stone for every person. Learn how income, enrollment timing, and even what kind of Medicare plan you choose can change your costs. Plus, see practical tips on lowering your monthly bill. Get clear, plain answers to the Medicare premium question.

Categories: Prescription Costs

0

PPO Plan Downsides: What You Need to Know

Curious about PPO health insurance? This article breaks down why some people might want to think twice before picking a PPO plan. We'll get into the main drawbacks, from higher costs to coverage confusion. Expect real-life tips on figuring out if a PPO fits your needs—or if another option makes more sense. If you want straight talk about private healthcare, you're in the right place.

Categories: Private Healthcare

0

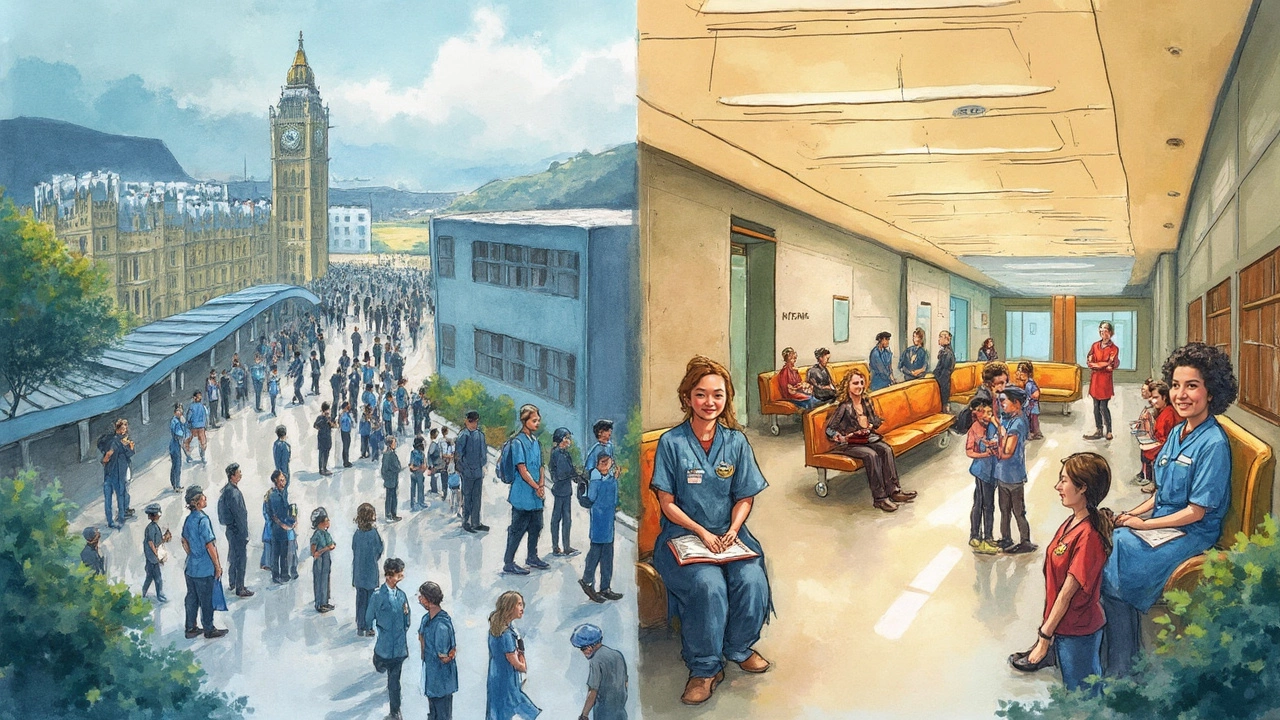

Private Healthcare vs. NHS: Making the Right Choice

Is private healthcare in the UK worth it, or should you stick with the NHS? This article explores the differences between private and NHS healthcare, discussing factors like cost, waiting times, and care quality. It also offers insights into how each system operates and provides tips on making an informed choice based on your health needs. Whether it's a matter of cost or convenience, find out what suits you best.

Categories: Healthcare Insurance UK

0

Choosing the Best Health Insurance Provider in 2025

Navigating the world of health insurance can be overwhelming, but understanding the current landscape can help you make an informed choice. This article explores the top providers of private healthcare insurance in 2025, highlighting their unique offerings and benefits. From coverage options to customer service, get insights on what to consider in your selection process. The article aims to help you find a policy that aligns with your medical needs and financial situation. Whether you prioritize comprehensive coverage or affordable rates, we've got the information you need.

Categories: Private Healthcare

0