Medicare Part D Cost Calculator

Calculate Your Monthly Premium

Find out your estimated monthly Medicare Part D cost based on your income and location.

Your Estimated Monthly Cost

Base premium:

IRMAA: $0.00

Extra Help: $0.00

Note: This is an estimate based on the 2025 Medicare Part D average premium. Your actual cost may vary based on specific plan choices and medications.

Income Thresholds (2025)

Medicare Part D is the part of Medicare that covers prescription drugs. If you’re on Medicare and take regular medications, you need to know exactly how much you’ll pay each month - because the cost isn’t the same for everyone. Some people pay as little as $10 a month. Others pay over $100. And that’s before you even factor in what you spend at the pharmacy. The truth? There’s no single answer. But there is a clear way to figure out what you’ll actually pay.

What’s the average monthly cost for Medicare Part D in 2025?

In 2025, the average monthly premium for a stand-alone Medicare Part D plan is around $34. That’s the number you’ll see on most government websites. But here’s the catch: that’s just an average. It’s pulled from hundreds of plans across the country, mixing cheap plans with expensive ones. If you live in a state with lower drug prices - like Texas or Ohio - your premium might be closer to $20. In states like New York or California, it could be $45 or more. And if you’re in a high-income bracket, you’ll pay extra.

The basic structure of Part D costs has three parts: the monthly premium, the deductible, and what you pay at the pharmacy. Most plans have a deductible - meaning you pay the full cost of your drugs until you hit that amount. In 2025, the maximum deductible allowed is $590. Some plans have no deductible at all, but they usually charge a higher monthly premium to make up for it.

How income affects your Part D premium

If your income is above a certain level, you pay more. This is called the Income-Related Monthly Adjustment Amount, or IRMAA. For 2025, if you file taxes as an individual and your income is over $106,000, you’ll pay extra. If you’re married and file jointly and make over $212,000, you’ll pay extra too.

Here’s how it breaks down:

- Individual income $106,000-$133,000: +$12.40/month extra

- Individual income $133,000-$160,000: +$31.10/month extra

- Individual income $160,000-$500,000: +$77.90/month extra

- Individual income over $500,000: +$134.70/month extra

For couples, the income thresholds are double. So if you’re a couple making $250,000, you’d pay an extra $77.90 each month. That’s not just on your Part D plan - it’s added to your Medicare Part B premium too. Most people don’t realize this extra charge exists until they get their bill.

What you pay at the pharmacy isn’t the same as your premium

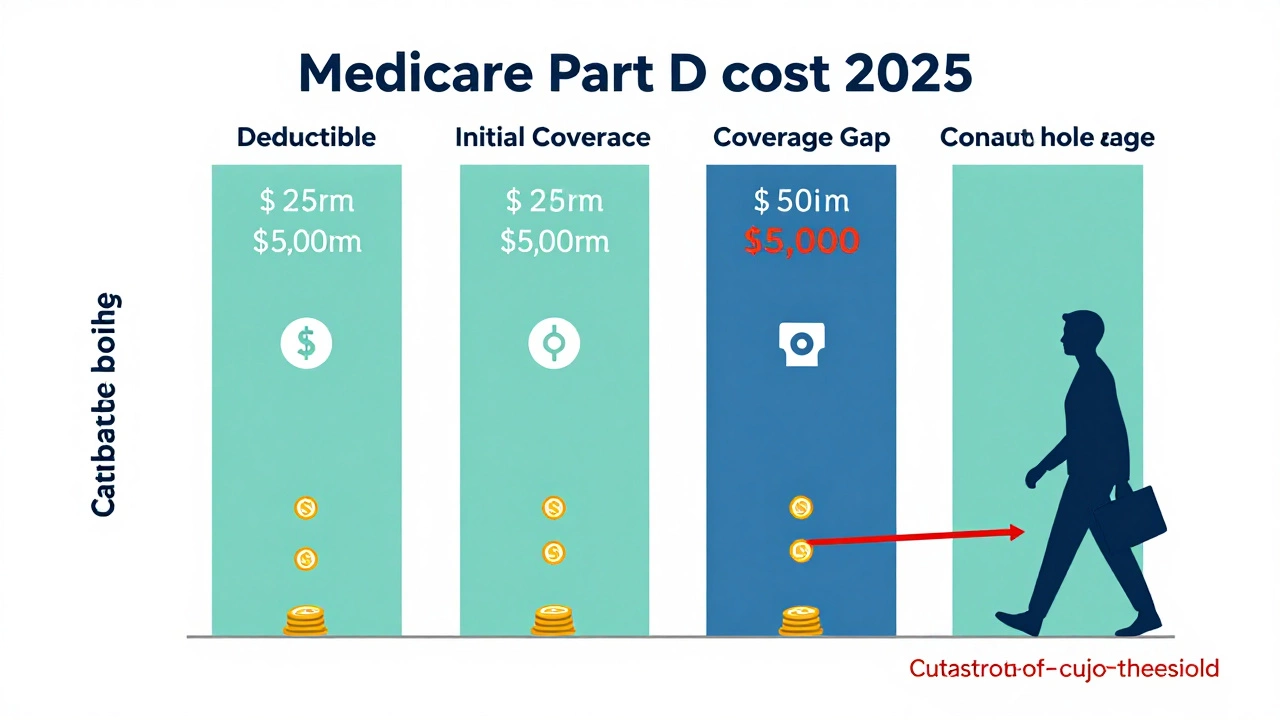

Your monthly premium is just one piece. The real cost comes when you pick up your prescriptions. Most plans have four phases: deductible, initial coverage, coverage gap (donut hole), and catastrophic coverage.

In 2025, once you’ve spent $5,000 out-of-pocket on drugs (including what you paid during the deductible and your share of costs), you hit catastrophic coverage. After that, you pay the lesser of 5% of the drug cost or a small copay - $4.50 for generics and $11.20 for brand-name drugs. That’s a big drop from what you were paying before.

But here’s what trips people up: the $5,000 out-of-pocket limit doesn’t include your monthly premium. It also doesn’t include what your plan pays. Only what you pay - your copays, coinsurance, and deductible - counts toward that $5,000. So if your insulin costs $300 a month and you pay 25% of that, you’re spending $75 a month toward the limit. That means it takes you over 66 months to reach catastrophic coverage if you’re only on one expensive drug. Most people don’t realize how long that takes.

Low-income subsidies can cut your costs dramatically

If your income is low, you might qualify for Extra Help - a federal program that lowers your Part D costs. In 2025, if you’re single and make less than $22,590 a year, or married and make less than $30,660, you could pay as little as $0 for your monthly premium. You might also pay $0 for your deductible and only $1.70 for generics and $4.25 for brand-name drugs at the pharmacy.

Even if you’re a little over the income limit, you might still qualify for partial help. About 6 million people get Extra Help each year. But only about half of those who qualify actually sign up. You can apply through Social Security or your state Medicaid office. It’s not automatic. You have to ask.

Plan choices matter more than you think

All Part D plans are not created equal. Two plans might have the same premium, but one covers your specific drugs and the other doesn’t. Or one might have a lower copay for your medication. You need to look at your actual prescriptions, not just the monthly cost.

For example, if you take metformin for diabetes and lisinopril for blood pressure, you should search for plans that list those drugs on their formulary. Then compare the copays. One plan might charge $5 for metformin and $12 for lisinopril. Another might charge $10 for metformin and $3 for lisinopril. The second plan could save you $84 a year - even if its premium is $10 higher.

Use the Medicare Plan Finder tool. It’s free, official, and updated every year. Enter your zip code, your drugs, and your pharmacy. It will show you exactly what you’ll pay. Don’t just pick the cheapest premium. Pick the plan that’s cheapest for your drugs.

When can you change your Part D plan?

You can switch plans during the Annual Enrollment Period, which runs from October 15 to December 7 each year. Changes take effect January 1. If you qualify for Extra Help, you can switch plans at any time during the year. You can also switch if you move out of your plan’s service area or if your plan drops your drug.

Don’t wait until the last minute. Many people wait until December and then realize their favorite plan is no longer available. Or they find out their pharmacy isn’t in-network. Plan ahead. Check your current plan’s notice of changes - it should arrive in September. It tells you if premiums, copays, or covered drugs are changing next year.

What happens if you don’t enroll when you’re first eligible?

If you don’t sign up for Part D when you first qualify for Medicare - unless you have other creditable drug coverage - you’ll pay a late enrollment penalty. It’s 1% of the national base premium for every month you delay. For 2025, the base premium is $34. So if you wait 12 months, you’ll pay an extra $3.40 per month forever. That’s not a one-time fee. It’s added to your premium for as long as you have Part D.

That penalty is permanent. Even if you later get Extra Help or switch to a cheaper plan, the penalty stays. So if you’re turning 65 and don’t have drug coverage through an employer or union, sign up for Part D. Even if you don’t take any drugs now. Your health can change fast.

How to find the best plan for your needs

Here’s a simple checklist to follow every year:

- List all your prescription drugs, including doses and how often you take them.

- Find out which pharmacies you use - and whether they’re in-network.

- Go to Medicare.gov/plan-compare and enter your info.

- Sort results by “Total Estimated Annual Cost” - not just premium.

- Check if your drugs are covered and at what tier (lower tiers = cheaper).

- Call the plan’s customer service and ask: “Will my drugs be covered next year?”

Don’t trust your memory. Plans change every year. What was cheap last year might be expensive this year. And what was covered might be dropped. The only way to know is to check.

What if I can’t afford my Part D plan?

If your premiums or drug costs are too high, you have options. First, apply for Extra Help. Second, ask your doctor if there’s a cheaper generic alternative. Third, check if your drug manufacturer offers a patient assistance program. Many big drug companies give free or discounted drugs to people who qualify.

Some states also have State Pharmaceutical Assistance Programs (SPAPs). These are state-run programs that help pay for prescriptions. They’re not the same as Medicaid, but they can help if you don’t qualify for Extra Help.

And remember: you’re not alone. Millions of people struggle with prescription costs. You have rights. You have options. You just need to take the first step - check your plan, ask questions, and don’t assume you’re stuck with what you have.

Is Medicare Part D mandatory?

No, Medicare Part D is not mandatory. But if you don’t sign up when you’re first eligible and you don’t have other creditable drug coverage, you’ll pay a late enrollment penalty for as long as you have Part D. That penalty is 1% of the national base premium for every month you delay. It’s permanent, even if you later qualify for low-income help.

Can I get Medicare Part D for free?

Yes, if you qualify for Extra Help - a federal program for people with low income. In 2025, if your income is below $22,590 (single) or $30,660 (married), you may pay $0 for your monthly premium, $0 for your deductible, and only $1.70 for generics and $4.25 for brand-name drugs. Many people who qualify don’t apply, so it’s worth checking.

Do all Medicare Part D plans cover the same drugs?

No. Each plan has its own list of covered drugs, called a formulary. Some plans cover certain brand-name drugs, others don’t. Some have lower copays for generics. You must check that your specific medications are covered and at what cost before choosing a plan. The same drug can cost $2 at one plan and $40 at another.

What is the Part D coverage gap (donut hole)?

The coverage gap, or donut hole, is a phase in your Part D coverage where you pay more for your drugs after you and your plan have spent a certain amount. In 2025, once you’ve spent $5,000 out-of-pocket on drugs, you enter catastrophic coverage. Before that, you pay a percentage of the drug cost - usually 25% for generics and 25% for brand-name drugs, with manufacturers covering 75% of the brand-name cost. The donut hole isn’t a full gap anymore - you still get discounts.

Can I change my Part D plan anytime?

You can only change your Part D plan during the Annual Enrollment Period (October 15 to December 7) unless you qualify for a Special Enrollment Period. These include moving out of your plan’s service area, losing other drug coverage, or qualifying for Extra Help. If you get Extra Help, you can switch plans once a month.

What happens if I miss the enrollment deadline?

If you miss the Initial Enrollment Period and don’t have other creditable drug coverage, you’ll pay a late enrollment penalty. It’s 1% of the national base premium for every month you delay. For 2025, that’s $0.34 per month for every month you’re late. This penalty is added to your monthly premium forever - even if you later get Extra Help or switch plans.

If you’re on Medicare and take prescriptions, your Part D plan is one of the most important decisions you’ll make each year. It’s not just about the monthly premium. It’s about what you pay at the pharmacy, whether your drugs are covered, and if you qualify for help. Take 20 minutes this fall to review your plan. You could save hundreds - or even thousands - over the next year.