Social Security Tax Calculator

How much of your Social Security is taxable?

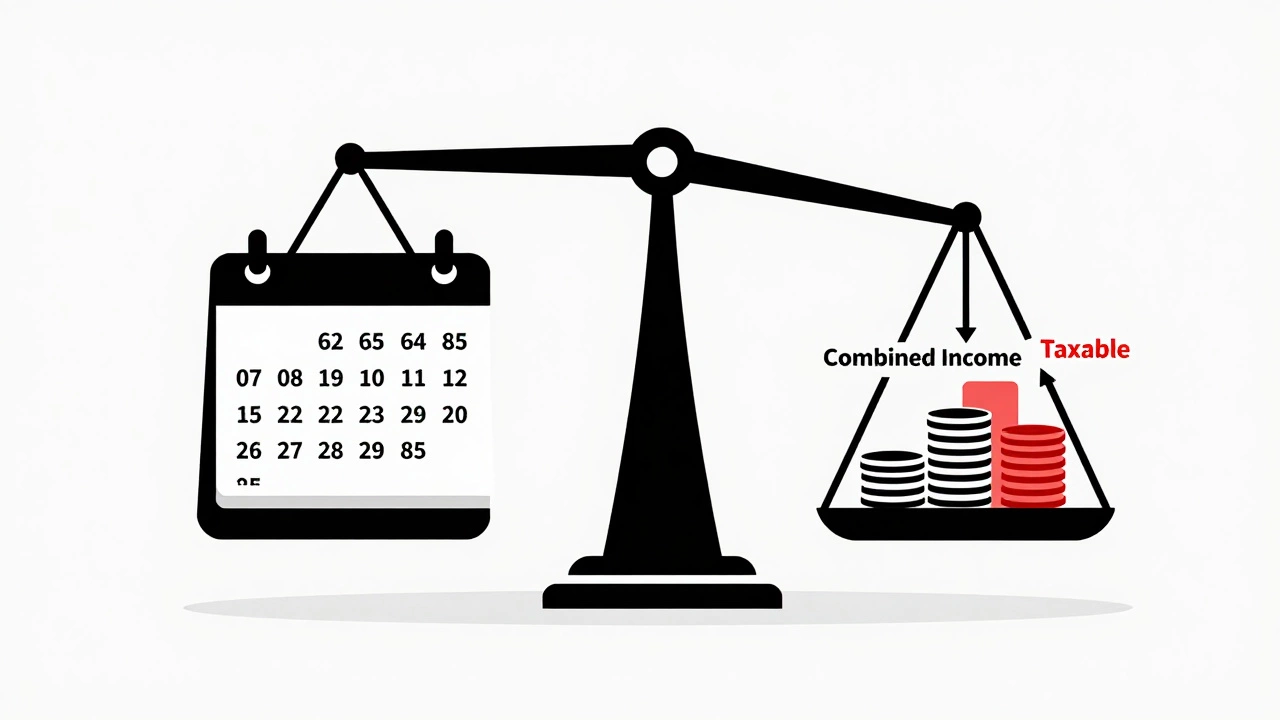

Based on IRS rules - age doesn't matter, only your combined income.

Many people assume that once they hit a certain age, their Social Security payments suddenly become tax-free. That’s not true. There’s no magic birthday when the IRS stops taxing your Social Security benefits. The truth is more complicated-and it depends on your total income, not your age.

There’s no age when Social Security stops being taxed

You won’t find a single age-65, 67, 70, or any other-where Social Security automatically becomes tax-free. The IRS doesn’t use age to decide if your benefits are taxable. Instead, they look at your combined income. That’s your adjusted gross income, plus nontaxable interest, plus half of your Social Security benefits.

If you’re single and your combined income is under $25,000, you won’t pay taxes on your Social Security. If it’s between $25,000 and $34,000, up to 50% of your benefits might be taxed. Above $34,000? Up to 85% can be taxed. For married couples filing jointly, the thresholds are $32,000 and $44,000.

So even at 80 years old, if you’re still earning income from a part-time job, withdrawals from a 401(k), or investment dividends, your Social Security could still be taxed. Age doesn’t change the rules. Your finances do.

Why people think age matters

The confusion comes from mixing up two different milestones: when you can claim full retirement benefits and when you stop paying taxes on them.

Full retirement age-the point where you get 100% of your Social Security benefit-is 67 for people born in 1960 or later. Some think once you hit that age, taxes disappear. But that’s not how it works. Full retirement age affects how much you get, not how much the government takes.

Another source of confusion? Medicare premiums. When you turn 65, you enroll in Medicare, and that’s when many people start thinking about retirement taxes. But Medicare premiums are deducted from your Social Security check-they don’t change the tax status of the benefit itself.

People also hear that pension income or 401(k) withdrawals become more tax-friendly after a certain age. That’s true for penalty-free withdrawals (age 59½), but again, that doesn’t mean your Social Security becomes untaxed.

How your other income affects Social Security taxes

Let’s say you’re 72 and retired. You live on Social Security and a small pension. You don’t work. Your combined income is $20,000. You pay $0 in taxes on your Social Security.

Now imagine you retire at 67, then decide to take $15,000 from your traditional IRA at age 70. That $15,000 counts toward your combined income. Suddenly, your total goes from $20,000 to $35,000. Even though you’re older, you’re now in the 85% taxable range. Your Social Security benefit, which was tax-free before, is now partially taxed.

This is why many retirees get surprised. They thought retiring meant their income dropped. But if they start tapping retirement accounts, selling investments, or even earning side income, their tax bill on Social Security can jump.

What actually reduces Social Security taxes

Age doesn’t help. But these things do:

- Delaying Social Security: Waiting until 70 to claim means you get higher monthly payments. That can reduce how much you need to withdraw from taxable accounts later.

- Using Roth accounts: Roth IRA withdrawals aren’t counted in your combined income. If you’ve been contributing to a Roth over the years, those withdrawals won’t push you into a higher tax bracket on Social Security.

- Managing withdrawals: Plan your 401(k) or traditional IRA withdrawals carefully. Taking smaller amounts in your early 70s can keep your combined income under the tax threshold.

- Reducing taxable investments: Sell stocks with losses to offset gains. Move to tax-efficient funds. Lower your overall taxable income, and you lower your Social Security tax.

Some retirees even move to states with no income tax. That doesn’t change federal taxes on Social Security-but it can reduce your overall tax burden.

What about state taxes?

Federal rules don’t care about age. Neither do most states. But 13 states still tax Social Security benefits in some form, including Minnesota, Nebraska, North Dakota, Vermont, and West Virginia.

Some of these states offer exemptions based on age or income. For example, in Missouri, if you’re 65 or older and your federal adjusted gross income is under $85,000 (single) or $100,000 (married), you can exclude your Social Security from state taxes.

So while federal law doesn’t give you a tax break at a certain age, your state might. Check your state’s rules. Don’t assume because you’re over 70, you’re free and clear.

Common mistakes retirees make

Here’s what trips people up:

- Thinking their tax bracket drops automatically at retirement. It doesn’t-if they withdraw too much from taxable accounts.

- Assuming Medicare premiums are the same as taxes. They’re not. Premiums are deducted from your check, but they don’t affect whether your benefit is taxable.

- Waiting until April to realize they owe taxes on Social Security. The IRS expects quarterly payments if you’re not having taxes withheld.

- Not adjusting withholding after a big withdrawal. If you take $50,000 from your IRA in one year, you might owe thousands in taxes on your Social Security that year-and you didn’t plan for it.

Many retirees end up with a surprise tax bill because they didn’t run the numbers before pulling money out. A $10,000 IRA withdrawal might seem harmless. But if it pushes your combined income over $34,000, it can make $8,500 of your Social Security taxable. That’s an extra $1,275 in federal taxes-on top of the tax on the IRA withdrawal.

What to do now

If you’re approaching retirement or already receiving benefits:

- Calculate your combined income using the IRS formula: AGI + nontaxable interest + 50% of Social Security.

- Use the IRS worksheet (Form 1040 instructions, page 31) or a free online calculator to estimate your taxable benefits.

- Plan your withdrawals. Aim to keep your combined income below the thresholds.

- Consider converting traditional IRA funds to a Roth IRA in low-income years-before you start taking Social Security.

- Talk to a tax professional. A single year of over-withdrawal can have lasting effects on your tax bill.

There’s no age when Social Security becomes untaxed. But there are smart, proactive steps you can take to reduce or even eliminate taxes on your benefits-no matter how old you are.

Is Social Security taxed after age 70?

Yes, Social Security can still be taxed after age 70. The IRS doesn’t use age to determine taxation. It looks at your combined income. If your income from other sources-like retirement accounts, pensions, or investments-pushes your total above the threshold, up to 85% of your benefits may be taxable, no matter how old you are.

At what age do you stop paying taxes on Social Security?

There is no age when you automatically stop paying taxes on Social Security. Taxation depends on your total income, not your age. Even at 85, if your combined income exceeds $34,000 (single) or $44,000 (married), part of your benefits may be taxed.

Does Social Security count as income for tax purposes?

Yes, but only partially. Half of your Social Security benefit is included in your combined income for tax calculations. If your total combined income (including other sources like pensions or IRA withdrawals) is high enough, up to 85% of your benefit becomes taxable. It’s not counted as regular income, but it triggers taxes when combined with other income.

Can I avoid taxes on Social Security by retiring early?

Retiring early doesn’t automatically avoid taxes on Social Security. If you start drawing from a traditional 401(k) or IRA early, those withdrawals count toward your combined income. You might actually trigger taxes on your Social Security sooner by withdrawing too much too soon. The key is managing your total income, not just when you stop working.

Do I pay taxes on Social Security if I’m still working after 70?

Yes, if you’re working after 70 and earning income, that income is added to your total combined income. If your total exceeds the IRS thresholds, up to 85% of your Social Security benefits may be taxed. Working doesn’t protect you from taxes-it can make them worse if you’re not careful.